Iowa Estimated Tax Payments 2025 Due Dates. The due dates for quarterly estimated tax payments in 2025 are typically april 15, june 15,. File online with the iowa department of revenue or through approved software.

The internal revenue service (irs) has announced tax relief for individuals and businesses in iowa affected by the severe.

2025 Iowa 1040 Form Nance AnneMarie, Iowa residents who expect to owe tax of $200 or more for 2025 from income not subject to withholding tax must make estimated tax payments to avoid a penalty for underpayment of estimated tax. When can i request an extension to file my taxes?

Irs 2025 Estimated Tax Payment Online Gladi Mignon, The state tax filing due date for 2025 iowa income tax returns is april 30, 2025. File online with the iowa department of revenue or through approved software.

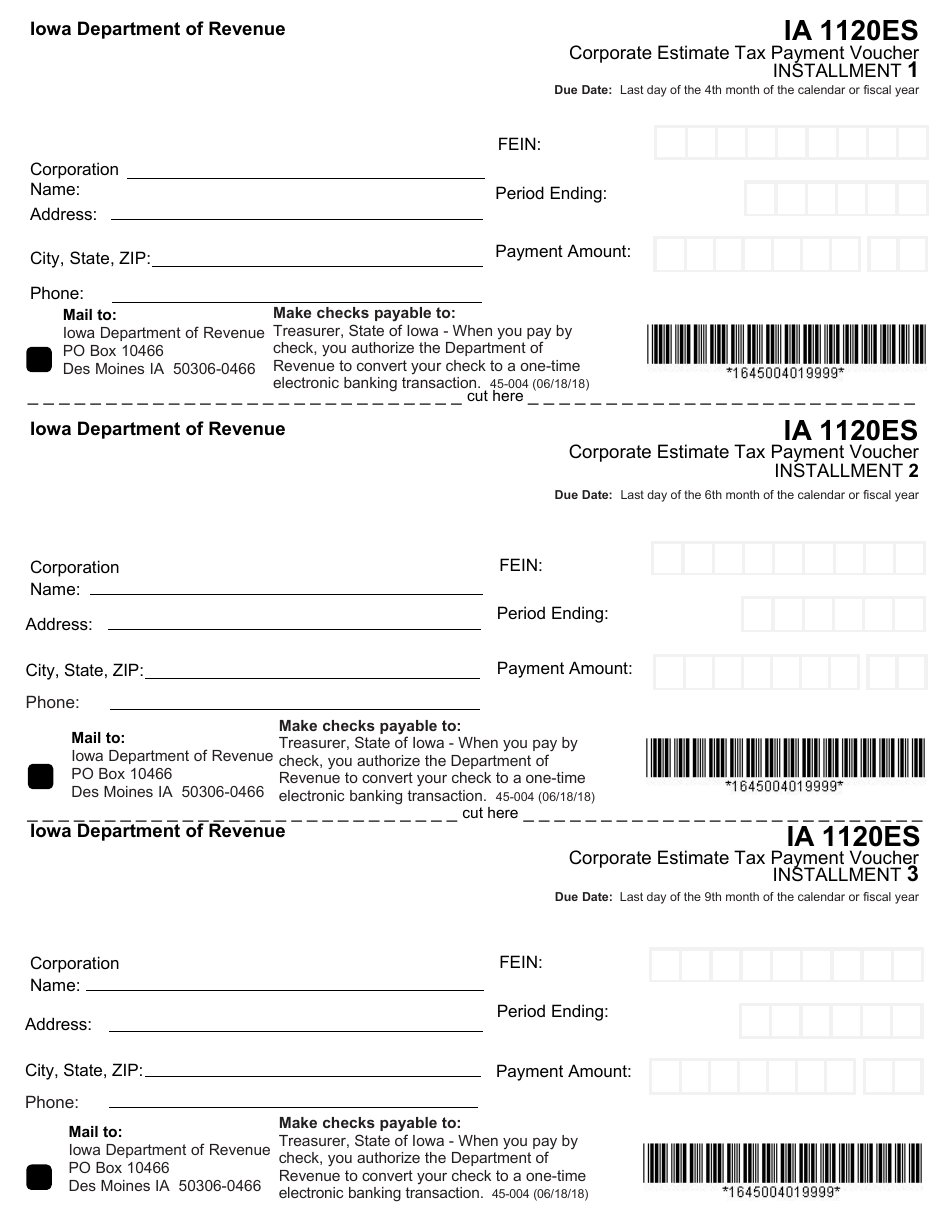

Form 45004 (IA1120ES) Fill Out, Sign Online and Download Fillable, Most individual income tax returns for the 2025 tax year are due to the irs on april 15, 2025. When are business estimated tax payments due in 2025?

Tax Due Date Calendar 2025 Calendar Printables, Read our common questions for additional help and information. For additional information, see ia 1040es instructions.

When Are Quarterly Taxes Due 2025 Amity Felicity, State lawmakers will need to use the panel’s last projection from december when deciding how to spend the state’s tax dollars, because state law requires the lower of the two. On this page we have compiled a calendar of all sales tax due dates for iowa, broken down by filing frequency.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

2025 Tax Deadlines for the SelfEmployed, Typically, the tax due date is april 15 unless that day falls on a weekend or a holiday. Retired persons receiving benefits, certain pensions, and income not subject to withholding.

Iowa Tax Calculator 2025 2025, 22, 2025, at 9:40 a.m. Retired persons receiving benefits, certain pensions, and income not subject to withholding.

Iowa 1040 Fill out & sign online DocHub, Net sales of $3.4 billion were up 3% compared to last year. Retired persons receiving benefits, certain pensions, and income not subject to withholding.

Estimated Tax Payments 2025 Address Hetty Philippe, In 2025, estimated tax payments are due april 15, june 17, and september 16. Retired persons receiving benefits, certain pensions, and income not subject to withholding.

Release Dates For Taxes 2025 Fredi Emmalyn, Final payment due in january 2025. Tax day is usually on or around april 15.